The continuing cost-of-living crisis is putting extraordinary pressure on UK households. It is at times like this, that the real Living Wage is all the more important for workers and their families. As the only UK wage rate to be based on the cost of living and to rise on an annual basis, in this blog we break down the things you need to know about the new 2023-24 real Living Wage rates, announced this week.

1. What they are?

The new real Living Wage rates are £12 across the UK, and £13.15 in London. The real Living Wage rates are the only UK wage rate to be independently calculated on the cost of living.

This represents a 10% increase, which reflects that living costs continue to rise sharply hitting low paid workers hardest.

For workers covered by the real Living Wage already because they are employed by accredited Living Wage Employers, the new rates will mean an extra £2,145 per year for UK workers and an additional £2,350 for those in London.

You can find out more about these increases here.

2. How are they calculated?

The real Living Wage rates are calculated annually to reflect the rising cost of living.

The Living Wage rates are calculated by the Resolution Foundation, based on a core ‘basket of goods and services’ that people in the UK believe is necessary to meet everyday needs. There is also an independent Living Wage Commission who decide on the final rates, and take into consideration any additional factors such as policy changes.

The process is robust and uses the best available data at the time. The best way to get your head around the calculation is to watch our animation below.

3. Who pays these new rates?

The real Living Wage is voluntarily paid by over 14,000 accredited Living Wage Employers including names you might recognise – Ikea, Nationwide, Liverpool FC, and thousands of SMEs. 1 in 9 UK workers now works for a Living Wage Employer.

If an employer is accredited, it means that no one is left behind. Employers commit to pay everyone, including third party contracted staff such as cleaners or catering staff, a real Living Wage too.

Because of our growing movement of employers wanting to do the right thing, £3 billion has gone back into the pockets of low-paid workers.

The Living Wage movement continues to grow. In the past three years, the number of Living Wage Employers has more than doubled, with more and more recognising the importance of paying a real Living Wage as a result of the pandemic and ongoing cost-of-living crisis.

4. What is the annual financial difference for workers compared the government’s minimum?

The difference with the government’s ‘National Living Wage’ is significant, with full-time workers earning £5,323.50 a year more in London, and £3,081 a year more outside of London.

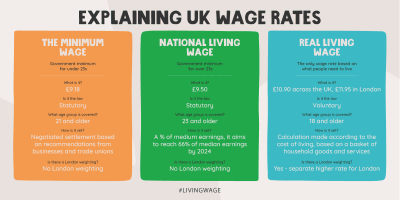

The real Living Wage also applies to everyone over 18, unlike the governments ‘National Living Wage’ which applies to only over 23’s. Find out other key differences in our UK Wage Rates explainer table below.

5. Who benefits?

With over 460,000 UK workers set to receive a pay boost because of this year’s rates, it’s clear these new rates will provide workers and their families with greater security and stability which will be necessary amid unparalleled rises to the cost of living.

But there’s also benefits to businesses. 94% of accredited Living Wage Employers report business benefits. Living Wage employers found that:

- 87% say it’s improved the reputation of the business.

- 66% say it’s helped differentiate them from others in their industry.

- 64% say it improved relations between management and staff.

- 62% of employers say paying a real Living Wage has improved recruitment of employees.

- 60% of employers say paying a real Living Wage has improved retention of employees.

There are also benefits to society. Increasing the number of people earning a real Living Wage boosts local economies by creating a “multiplier effect” with money going back into the economy through higher spending and productivity. Our research with the Smith Institute found that if 25% more people were paid a real Living Wage the national boost would be £1.7 billion.

The best thing employers can do to support staff during these difficult times is become a Living Wage Employer. Start your accreditation journey today.