New research has found that after five years, the National Living Wage (NLW) has significantly boosted pay for the low paid, but a large gap remains between the government's minimum wage for over 23s and a real Living Wage based on the cost of living.

New analysis by the Living Wage Foundation assessing the number of workers on the NLW each year and their working hours has found NLW earners have collectively received £10bn less than they would have earned on the real Living Wage, over the NLW's five-year history.[1]

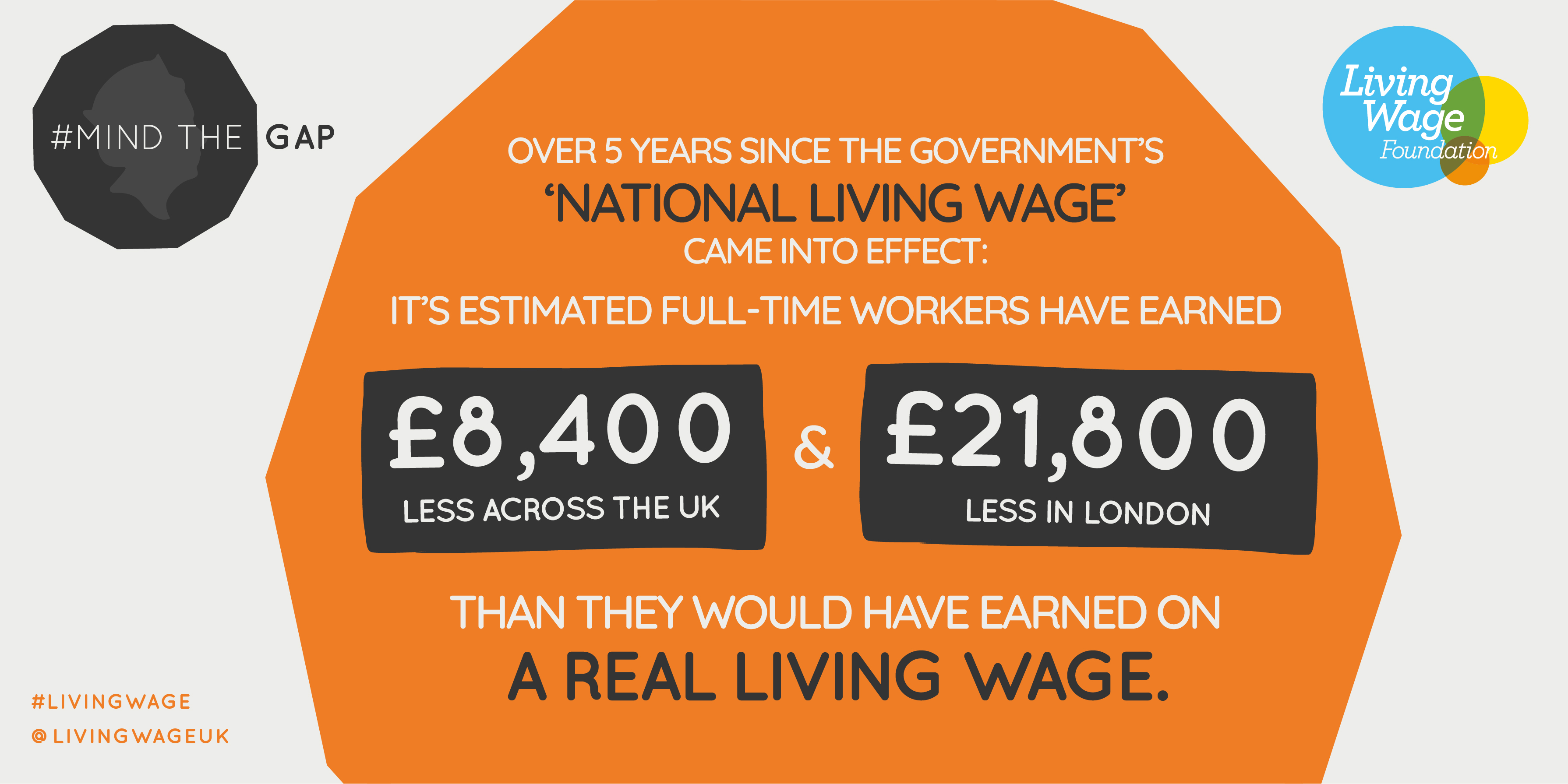

Over these five years, the Foundation finds that a full-time worker[2] on the NLW has lost out on £8,400 across the UK and £21,800 in London, compared to a worker earning the real Living Wage.

The NLW - the minimum wage for workers aged 25+ (coming down to those aged 23+ with today's increase) - has spearheaded a welcome new era of minimum wage ambition and delivered significant pay boosts to low earners. It was introduced in 2016 at a rate of £7.20 with an initial target for the rate to reach 60% of median UK earnings by 2020. Since then the rate has seen significant increases, and the target has been increased to two-thirds of median earnings by 2024. Today's increase in the NLW sees the rate rise 2.2% to £8.91.

The Living Wage Foundation calculates that full-time NLW earners are now £2,700 per year better off than they would have been if the minimum wage had instead continued increasing at its pre-2016 pace.[3] And the Foundation's analysis shows that the NLW has impacted a large proportion of workers over its five-year history - with around 1.5 million workers on it each year. The Foundation says this demonstrates the important role the NLW has played in reducing the depths of low pay.

However, despite its name, this new higher minimum wage continues to fall short of what it costs to live, driving the cumulative £10bn gap to the real Living Wage.

The real Living Wage, the only UK wage rate independently calculated based on the cost of living, stands at £9.50 outside of London, and £10.85 in London. A full-time worker over the age of 23 and earning the real Living Wage will receive £1,150 more over the coming year compared to a worker earning the minimum wage (NLW). For a worker in London that figure increases to £3,800. The UK gap is equivalent to:[4]

- 11 weeks' rent for a couple with one child.

- 23 weeks of food costs for a couple with one child.

- 41 weeks of council tax bills for a couple with one child.

The real Living Wage is voluntarily paid by over 7,000 leading businesses that choose to go beyond the government minimum and provide workers with a wage that meets everyday needs. These include household names like Aviva, Brewdog and Google, and Everton and Chelsea Football Clubs.

Laura Gardiner, Director of the Living Wage Foundation said:

"The introduction of the National Living Wage has delivered a solid pay rise to minimum wage workers, and it's welcome to see the government continuing to commit to ambitious increases. However, there is still a substantial gap between this wage rate and one based on the cost of living, with National Living Wage workers falling billions of pounds short of a real Living Wage over the past five years. The result has been millions of workers and families struggling to keep their heads above water.

"The number of employers signing up to the real Living Wage has continued to grow, even during the pandemic, as businesses recognise the benefits of a healthy and motivated workforce. Alongside a strong wage floor, more employers committing to go beyond the government minimum and pay a real Living Wage that meets the everyday needs of workers and families is how Britain recovers and rebuilds from this crisis."

For more information and any further enquiries, please contact:

- John Hood: john.hood@livingwage.org.uk / 07507 173649

- Tom Blin: thomas.blin@livingwage.org.uk / 07706 217589

Notes

[1] Calculations based on Living Wage Foundation analysis of ONS, Annual Survey of Hours and Earnings. The number of workers earning the NLW is estimated separately for men and women, in each year during 2016-2020. Based on previous analysis of working hours among low hourly earners, female NLW earners are assumed to work 24 hours per week, and male NLW earners are assumed to work 33 hours per week. The proportion of NLW workers in London is estimated based on Low Pay Commission analysis. 2019 data is used to estimate results for 2020, as no data is available due to the impacts of furloughing on estimating the 'true' number of NLW earners.

[2] Throughout our analysis, full-time hours are 37.5 hours per week.

[3] In the five years before the NLW's introduction, the adult minimum wage increased by an average of 2.3% per year (faster than the growth of either earnings or inflation in that period). If the NLW had continued increasing at this rate in the following five years, it would stand at £7.51 today.

[4] These costs are drawn directly from those used to calculate the real Living Wage, as detailed in the latest Living Wage methodology report, and Loughborough University analysis for the creation of the Minimum Income Standard.

About the Living Wage

The real Living Wage is the only rate calculated according to what people need to make ends meet. It provides a voluntary benchmark for employers that choose to take a stand, by ensuring their staff earn a wage that meets the costs and pressures they face in their everyday lives.

The UK Living Wage is currently £9.50 per hour. There is a separate London Living Wage rate of £10.85 per hour to reflect the higher costs of transport, childcare and housing in the capital. These figures are calculated annually by the Resolution Foundation and overseen by the Living Wage Commission, based on the best available evidence on living standards in London and the UK.

The Living Wage Foundation is the organisation at the heart of the movement of businesses, organisations and individuals who campaign for the simple idea that a hard day's work deserves a fair day's pay. The Living Wage Foundation receives guidance and advice from the Living Wage Advisory Council. The Foundation is supported by our principal partners: Aviva; IKEA; Joseph Rowntree Foundation; KPMG; Linklaters; Nationwide; Nestlé; Resolution Foundation; Oxfam; Trust for London; People's Health Trust; and Queen Mary University of London.

What about the government's National Living Wage?

In July 2015 the Chancellor of the Exchequer announced that the UK government would introduce a compulsory 'National Living Wage'. This new government rate was a new minimum wage for staff aged 25 years old and over. It was introduced in April 2016 and the rate is £8.91 per hour as of April 2021, with the age limit also coming down to 23+. The rate is different to the Living Wage rates calculated by the Living Wage Foundation. The government rate is based on median earnings, while the Living Wage Foundation rates remain the only ones calculated according to the cost of living in London and the UK.