Over a third of working parents on low incomes have regularly skipped meals due to a lack of money, and almost half have fallen behind on household bills, according to new research from the Living Wage Foundation.

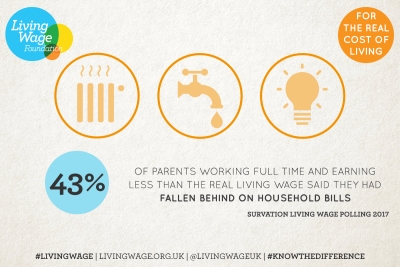

Polling conducted by Survation, polled 1,016 UK parents working full time and earning less than the real Living Wage, found:

- 37% said they had skipped meals regularly for financial reasons

- 43% said they had fallen behind on household bills

- 29% said they had fallen behind on their mortgage or rent payments

- 37% of respondents had topped up their monthly income with a credit card or loan

- 22% had taken out a payday loan to cover essential purchases

- 51% had borrowed money from a friend or relative

- 30% had walked to work as they couldn't afford the travel fare

- 55% had to decline a social invitation due to lack of cash

A real Living Wage

This report follows news earlier this month that there is still a significant gap between the government's ‘National Living Wage ‘and the real Living Wage. On April 1st the government minimum wage for the over 25s, the ‘National Living Wage,’ was raised from £7.50 to £7.83 an hour. However, analysis conducted by the Living Wage Foundation found that someone working full-time on this wage would be almost £1,800 a year worse off than someone earning the real Living Wage of £8.75, based on the cost of living [1]. Further analysis found that £1,800 could pay for more than six months’ food and drink bills for an average household [2], Over a year’s average gas and electricity bills [3], or almost 3 months' average rent [4].

Tess Lanning, Director of the Living Wage Foundation, said:

“These findings reveal the desperate choices low paid families have to make, and show why it’s so important that more employers take a stand by paying the real Living Wage, based on what they need to live, not just the government minimum.”

LIFE ON LOW PAY REPORT

This briefing sets out the findings from our polling with parents working full time but still not earning a wage they can live on. It highlights the difficult choices faced by workers earning little more than the government minimum across all areas of their lives.

Notes

- These calculations are based on working for 37.5 hours a week, for 52 weeks. £8.75 x 37.5 x 52 = £17,062.50 for someone earning the real Living Wage, compared to £15,269 for a full time worker, over the age of 25 (and therefore eligible for the National Living Wage), earning the government’s new National Living Wage rate of £7.83.

- Average weekly household food and drink bill is £58.00 x 52 weeks = annual food and drink bill of £3,016. Half of this is £1,508

- Combined prepayment average gas and electricity bill = £1,250. (DECC Quarterly energy prices, 2017

- In 2016-17, the average private rent outside London was £158 per week. Eleven weeks (nearly 3 months) private rent is therefore £1,738